2021 Half-Year Results

Highlights

- Significant like-for-like revenue increase of 26.8% year-on-year¹ and of 11.0% vs H1 2019, mostly due to very dynamic markets

- Like-for-like REBITDA increase of 60.3% year-on-year¹ and of 39.0% vs H1 2019, resulting from the top-line increase, improved margins and the impact of structural savings

- Significant increase in net recurring profit (Group share) at EUR 155 million (+ 106.8%)

- Strong free cash flow before dividends, acquisitions and disposals of EUR 116 million (vs EUR 50 million in H1 2020 and EUR 34 million in H1 2019) thanks to the REBITDA increase and despite a working capital increase compared to a low level in June 2020 due to the business slowdown (COVID-19)

- Net financial debt at EUR 182 million (vs EUR 310 million at the end of June 2020)

- Positive outlook for FY 2021 both in terms of top line and profitability

Comment from Paul Van Oyen, CEO of Etex: “Although the ongoing COVID-19 pandemic still heavily impacting people’s lives as well as the global economy in the first half of this year, the consequences for Etex cannot be compared to what we have experienced last year. The company benefitted from a very dynamic market (especially the home repair and improvement activities) as well as from the fact that our operations were hardly halted – whereas we suffered from several weeks of plant lockdowns in different countries during the second quarter of 2020. Moreover, the ambitious cost control measures we rapidly put in place last year continued to bear fruit in 2021. Overall, we maintained our focus on local decision-making, enabling our leaders on the field to take the right steps and inspiring the trust of our people. More importantly, we never lost sight of our ‘Inspiring ways of living’ purpose in the face of many challenges. All of this while keeping our relentless dedication to the safety and well-being of our people, which is and will always be our number one priority.

This combination of factors explains the outstanding half-year performance of the company. Like-for-like, our top-line increased with 27%, while our REBITDA reached a 60% increase and our net recurring profit (Group share) more than doubled last year’s result. Reporting our results not only year-on-year, but also compared with H1 2019, allows readers to analyse the performance in the light of the last “normal” year we have experienced.

From a strategic point of view, Etex reshaped its business portfolio over the last year focussing on plasterboard, fibre cement materials, passive fire protection and strengthening our new stream of revenue in modular and offsite construction. While we completed the acquisition of a major player on the Australian plasterboard market at the beginning of the year, our New Ways division, set up early 2020, successfully acquired no less than three European offsite construction experts – a fourth one having been completed early August. As for our fourth strategic pillar “Driving sustainability in the way we develop business”, we will communicate our results and define our ambitions in Etex’s first-ever Sustainability Report, to be released in September this year.”

Significant uplift of the top-line and profitability

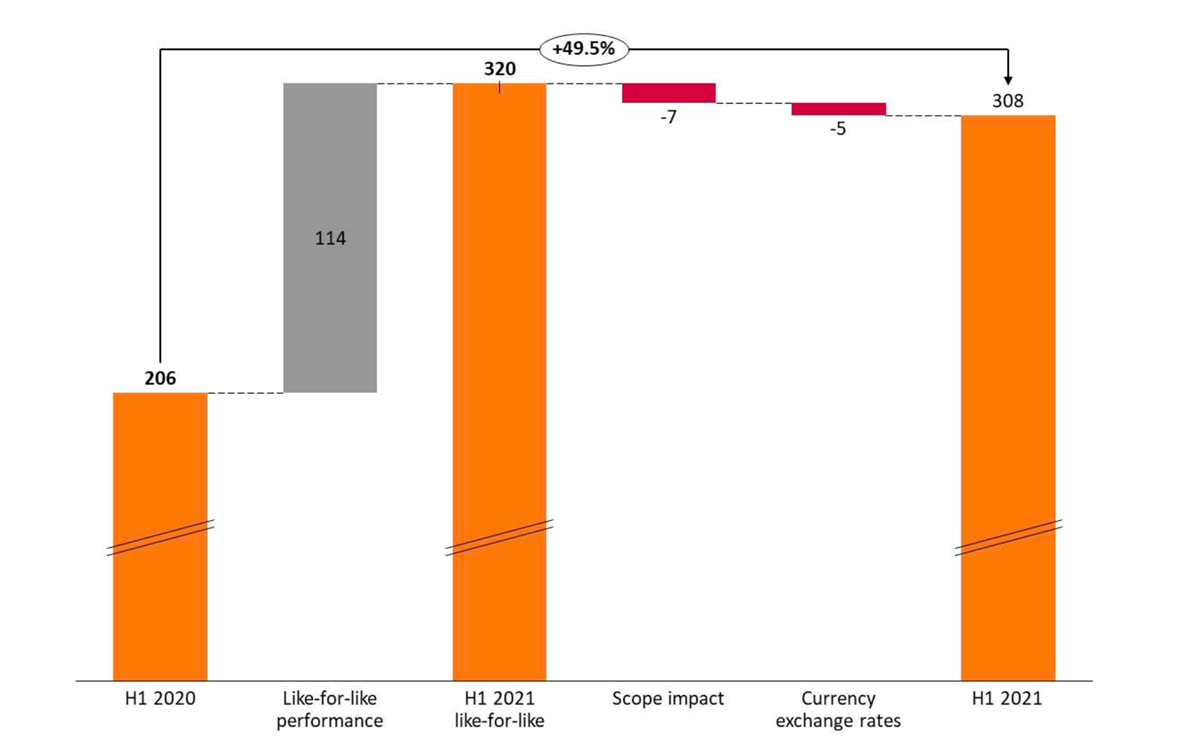

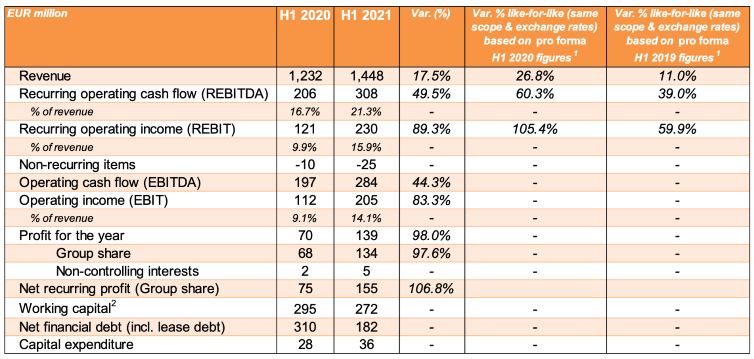

For the first six months of the year, Etex reports a revenue of EUR 1.448 billion, a like-for-like increase of 26.8% year-on year¹, and of 11.0% compared to H1 2019. This performance was driven by very dynamic markets favourably impacting nearly all operating countries and divisions (although Industry was still negatively impacted) and a favourable product mix impact. The upswing compared to 2020 was particularly strong during the second quarter, which was impacted last year by several weeks of factory lockdowns in several countries, resulting in market demand contraction and the temporary closure of several plants. The 4.6% negative scope impact is mainly attributable to the disposal of our Residential Roofing businesses (Creaton and Marley South Africa) in H1 2020, partially offset by the acquisition of FSi Limited, a passive fire protection business in the UK in H2 2020, and of a major plasterboard player in Australia (finalised early this year). The remaining negative impact on revenue is due to foreign currency translation mainly from a weaker Nigerian naira and Argentinian peso. Including the impact of the change of scope and currency exchange rates, the revenue was up 17.5% year-on-year, and down 4.6% compared to H1 2019.

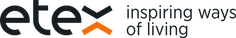

The recurring operating cash flow (REBITDA) reached a value of EUR 308 million, a like-for-like increase of 60.3% year-on-year¹, and of 39.0% compared to the first half of 2019. This performance is mainly attributable to the strong top-line increase and improved margins thanks to a favourable product mix. Overheads were strictly controlled from the beginning of the COVID-19 pandemic. While they were contained last year thanks to temporary savings and support due to the exceptional circumstances, they increased in H1 2021 due to the normalisation of the pandemic in most of our operational countries. This increase was however more than offset by structural, long-term savings initiatives, which shows particularly when comparing to H1 2019. When including the impact of scope and currency translation as well as the contribution of the Residential Roofing businesses in H1 2020, the year-on-year REBITDA increase in H1 2021 reached 49.5% (21.0% compared to H1 2019).

The REBITDA margin reached its highest level ever at 21.3%, compared to 16.7% in H1 2020, despite negative impacts of scope and foreign currency translation compared to the first half of 2020. The REBITDA margin stood at 16.8% in H1 2019.

Etex’s net recurring profit (Group share) was up by 106.8% year-on-year (55.3% vs H1 2019) to EUR 155 million in the first half of 2021. The company’s net profit reached EUR 139 million in H1 2021, up 98.0% year-on-year and 44.5% on H1 2019.

Over the last twelve months, Etex’s net financial debt strongly decreased from EUR 310 million at the end of June 2020 to EUR 182 million at the end of June 2021. The decrease is even more significant when comparing it with the end of June 2019, when it reached EUR 640 million. This reduction reflects the strong free cash flow generation and, to a lesser extent, the disposal proceeds net of acquisitions. The net financial debt/REBITDA ratio has improved from 1.1 x at the end of June 2020 (1.9 x at the end of June 2019) to

0.7 x at the end of June 2021.

Revenue by division

Building Performance registered a like-for-like revenue increase of 28.8% year-on-year (12.6% vs H1 2019) to reach EUR 1,029 million. The business delivered excellent results in the first half of this year, benefitting from a significant recovery of the markets after last year’s COVID-related lockdowns and temporary plant closures. The residential segment was especially strong thanks to dynamic DIY and renovation activities. Every operating region has performed well (particularly the UK, France, Argentina, Chile and Nigeria), with all product ranges (plasterboard, fibre cement, calcium silicate…) progressing compared to 2020 in terms of sales, volumes and margins.

The revenue of our Exteriors division increased with 26.4% like-for-like year-on-year (12.8% vs H1 2019) to EUR 326 million. The division delivered an excellent sales performance backed by a very active market. Sales volumes have been particularly high in Cedral sidings and slates. France, the UK and Latin America performed well, partially offset by lower export sales.

Our Industry division’s revenue increased with 7.7% like-for-like year-on-year yet declined with 12.0% compared to the first half of 2019. In Europe and the US, Industry was able to recover pre-COVID activity levels, but the AMEA region is still suffering from the impact of the pandemic (especially the Oil & Gas segment and Japan). Nevertheless, the current order book confirms the strong recovery in Europe and the US driven by the Energy and Defense segments. Furthermore, FSi Limited, the British fire protection specialist acquired by Etex in September 2020, has performed in accordance with the business plan expectations.

Finally, the revenue of our New Ways division, set up in January 2020, increased with 25.5% like-for-like year-on-year to EUR 7 million, with a good performance recorded by our EOS business (steel frame solutions) in the UK and the start of the Icon+ activities in Argentina. New Ways revenues exclude our non-consolidated participations in several joint ventures.

Key developments

Etex concluded a number of important acquisitions in the first six months of 2021:

- In Australia, we have completed at the end of February the acquisition (announced in November 2020) of a major plasterboard player (now Etex Australia Pty Ltd). This key strategic milestone will enable Etex to expand its footprint in this well-developed construction market.

- Our New Ways division has completed the following M&A operations in Europe:

- At the end of January, we acquired a majority stake in French offsite construction company e-Loft. Established in 2012, e-Loft offers innovative B2C and B2B solutions in three domains: modular single-family homes, modular multi-family residential complexes and custom-designed buildings.

- At the end of April, we acquired a majority stake in offsite design and engineering consultancy company Evolusion Innovation. Headquartered in Cork (Ireland), Evolusion Innovation are construction technology experts, specialised in offsite construction, who provide a one-stop-shop service for offsite companies and construction product manufacturers.

- In May, Etex acquired the Irish steel framing company Horizon Offsite, a specialist in lightweight steel framing for buildings of up to five storeys, including residential structures, schools and hospitals.

- Finally, after the end of the first half, we have Sigmat, the leading provider of light gauge steel framing (LGSF) in the UK, as well as one of the country’s first fully integrated offsite construction companies, offering design, engineering, manufacturing, assembly and installation services to its customers.

Etex’s Industry division concluded several contracts for the provision of high-performance, ultrathin insulation products used in both building applications and passively cooled containers for vaccine transport. With the latter, the company contributes to the timely and safe distribution of COVID-19 vaccines under ideal low-temperature conditions across the world. The products are manufactured at its site in Sint-Niklaas, Belgium.

In May, P&C Business Development Manager for DACHEE-SEE Dana Haiduc was the recipient of the 2020 Etex CEO Award, for delivering significant profitable growth in a dynamic market through innovation. She was announced as a winner by CEO Paul Van Oyen during a virtual ceremony gathering thousands of teammates. With this prestigious award, individuals and teams are saluted for achieving exceptional or transformative results for our organisation through their projects or initiatives.

Finally, in September this year Etex will release its first-ever Sustainability Report, in line with the requirements of the Global Reporting Initiative (GRI), tackling its progress, priorities and ambitions on all topics related to people and planet in 2020.

Positive outlook for FY 2021 both in terms of top line and profitability

For the second half of the year, the top line should continue to be favourably impacted by a very strong market, especially in Europe and for our plasterboard products. Etex continues to benefit from an expanding renovation market as customers have accumulated savings and are spending more on home repair and improvement. This dynamic market however carries the risk of a shortage of raw materials, in turn leading to production delays and higher input costs. The scope impact will be positive thanks to the inclusion of the recently acquired businesses (plasterboard player in Australia and several additions to the New Ways division). Outside Europe, the COVID impact is more severe, especially in Asia, Latin America and Africa, restricting workforce in some factories and closing construction sites.

The profitability and free cash flow generation should benefit from the dynamic business activity, as well as from the cost reduction programme delivering according to or above expectations. The overheads increase recorded in the first half is expected to continue due to the normalisation of the pandemic in most countries of operation. This impact should be partially offset by structural savings initiatives.

Key figures for H1 2021

¹ The year-on-year like-for-like percentages compare H1 2021 to H1 2020 and H1 2019, the latter being converted with identical exchange rates and excluding the Residential Roofing businesses divested during these periods.

² Values are expressed excluding the favourable impact of the non-recourse factoring programme (EUR 200 million as of 30/06/2021 and EUR 161 million as of 30/06/2020).