2019 Full-Year Results and Annual Report

Highlights:

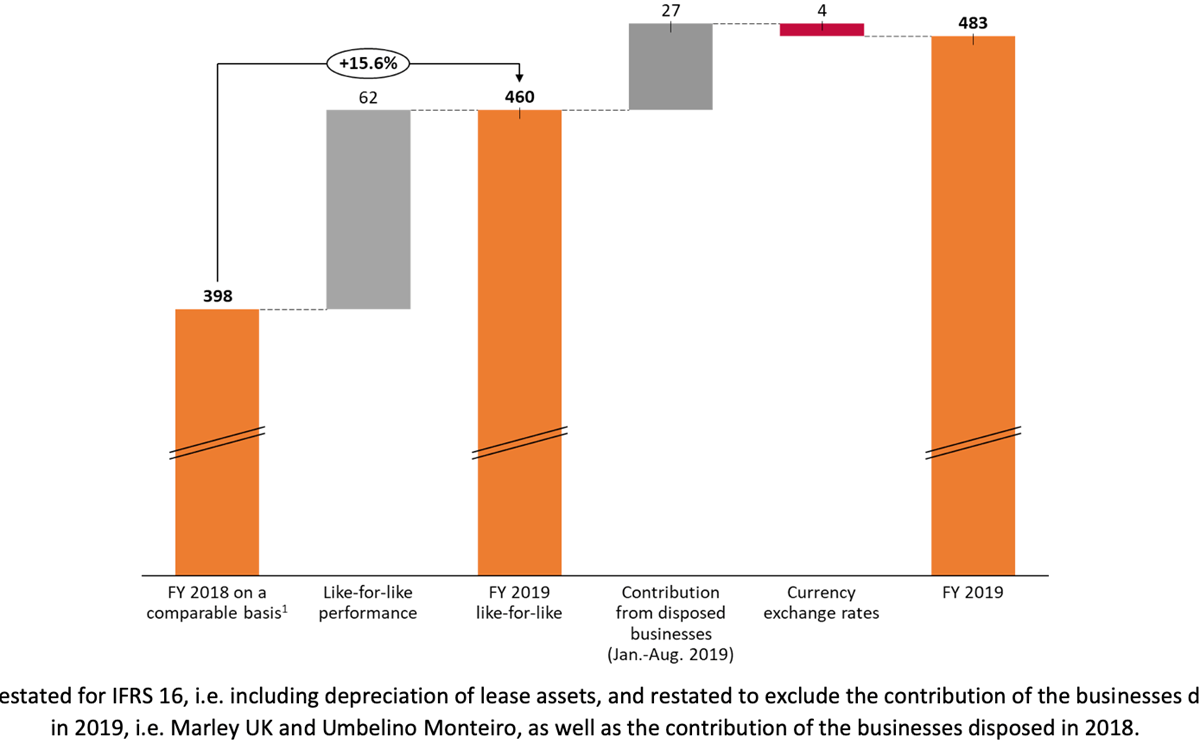

- Strong like-for-like revenue increase of 4.9%

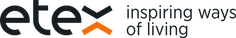

- Significant increase in like-for-like REBITDA with 15.6% thanks to an increase in volumes and an improved gross profit

- Significant increase in net recurring profit (Group share) at EUR 187 million (+ 12.7%), a record performance

- Lowest net financial debt since 2011

- Dividend over 2019 profit: proposal by the Board of Directors of a 50% reduction in the context of the COVID-19 sanitary crisis

- Outlook for 2020: significant impact of COVID-19 sanitary crisis, impossible to measure precisely at this stage

- Annual Report 2019 available here

Comment from Paul Van Oyen, CEO of Etex: It is with mixed feelings that I’m commenting on the 2019 performance of Etex while the world is still fighting the worst sanitary crisis of its recent history. In 2019 Etex has had an outstanding year, as we have delivered record results in many ways, supported by our performance culture. While our top-line increased by 4.9% like-for-like, increased volumes, improved gross profit and contained overheads have allowed us to record a remarkable 15.6% like-for-like REBITDA increase. Building Performance was the main contributor to this success, thanks to strong demand and improved margins, but our other divisions have had a great year too, with the exception of Exteriors which experienced a transitional year. Our net recurring profit (Group share) has reached a record high, while our indebtedness level has reached a record low since 2011. Last but not least, 2019 was a year of many key achievements on all of our strategic pillars.

Sadly, this year has taken a very different turn since the coronavirus outbreak has hit many populations around the globe. Numerous industries have been – and still are – severely disrupted and Etex is no exception, as some of our production sites have temporarily stopped or slowed down their activities. This will obviously have a major impact on our performance in 2020, although it is currently impossible to accurately determine it. I am nevertheless confident that our strong financial position, strengthened even more by our performance and strategic achievements last year, as well as a careful management of our cash position, will allow us to face this crisis and its aftermath.

Today, my thoughts mainly go to all of our colleagues and their families worldwide, especially the ones who have been infected with the coronavirus [+ comment on casualties, if any]. Etex will not change its identity as a result of this crisis: our priority is and will always be the health and safety of our colleagues and stakeholders worldwide. We are determined to take all the necessary measures to protect them, to support our customers by keeping our business running, and to continue to Inspire ways of living.”

Annual Report 2019: shining a light on our external stakeholders

In the Annual Report dedicated to our performance and achievements in 2019, we have decided to give the word to our customers and external partners, who are collaborating with Etex on inspiring projects all over the world:

- Project Casablanca in Chile, where Santiago-based housing developer Inmobiliaria Gestión Urbana united with lightweight construction pioneer and Etex-Arauco joint venture E2E to bring affordable, high-quality living spaces to hundreds of modest-income families.

- The Bristol Business School (UK), for which Stride Treglown architects sought the most beautiful, versatile and resilient façade cladding. They have found it with Equitone.

- Our partnership with Terhalle, a German construction firm which has championed Creaton roofing solutions almost from the start.

- The partnership between our Industry division and Lapinus, demonstrating how two competing companies can accomplish so much more when they work together.

Watch the four people stories and/or download the full report.

Outstanding year with all key performance indicators reaching record levels

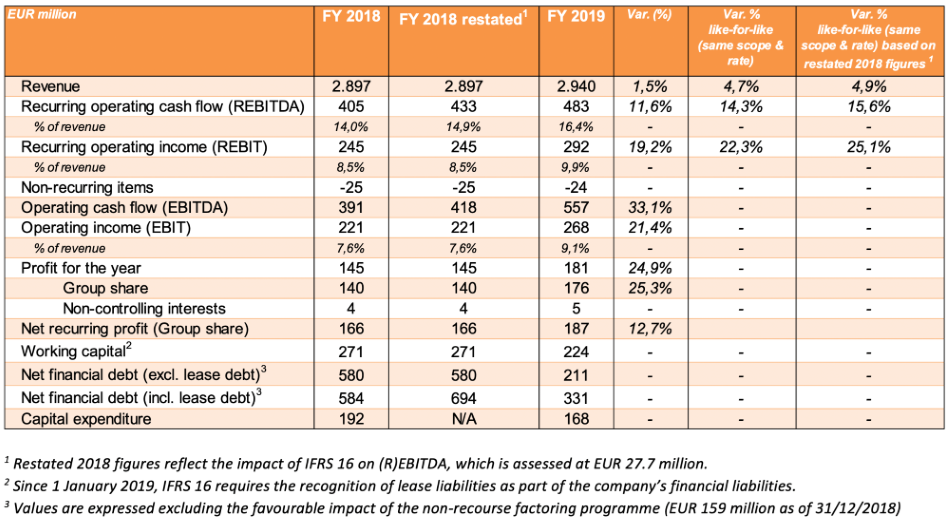

In 2019, Etex recorded a like-for-like (same currency exchange rates and scope) revenue growth of 4.9% to EUR 2,940 billion. Including the impact of the currency exchange rates and the change of scope, revenue was up 1.5%. This solid performance was achieved thanks to high demand and high volumes, especially in plasterboards, as well as improved margins. The growth in revenue benefitted from our geographical diversification, complementary routes to market, a good mix of project-based business and our wide product range. We have also continued to invest in our strong brands and improved our service levels. All of our divisions recorded top-line growth with the exception of Exteriors, which experienced a transitional year. The negative scope impact (-2.4%) is mainly attributable to the disposal of two tile roofing businesses in the UK and Portugal (more information on p. 53) and of French polypropylene honeycomb blocks and panels producer Nidaplast. The slightly adverse currency exchange rates (-1.0%) are mainly due to a weaker Argentine peso and British pound.

The recurring operating cash flow (REBITDA) reached EUR 483 million, including the EUR 28-million impact of additional depreciation linked to the new lease accounting rule. When compared to the comparable REBITDA in 2018, including leasing depreciation, this performance represents a like-for-like increase of 15.6%. This performance is mainly attributable to the combination of the increase in volumes and an improved gross profit, thanks to the focus on our product mix and the benefits reaped from a fully centralised procurement strategy. In addition, overheads have been contained, despite the strong top-line progression, thanks to restructuring measures decided upon at the end of 2018. The REBITDA margin reached its highest level ever at 16.4%, compared to 14.9% (pro forma: including restatement for depreciation of leasing) in 2018.

Despite an increase of net financial charges primarily related to the newly recognised lease debt, Etex’s net recurring profit (Group share) was up by 12.4% to EUR 187 million, another record performance. The non-recurring items mainly relate to impairment with respect to the Residential Roofing division, with significant gains on the disposal of businesses and impairments on the remaining businesses, as well as some restructuring costs. The company’s net profit reached EUR 181 million in 2019, up 24.9% year on year.

At the end of December 2019, Etex’s net financial debt decreased to EUR 331 million, a strong reduction despite the additional lease debt seen from 2019 due to compliance with the new lease accounting rules (EUR 120 million at year end, of which EUR 110 million in debt and assets was newly recognised from the beginning of 2019 after application of the new rules). At the end of 2018 it reached EUR 584 million (EUR 694 million including new leasing debt). In addition to strong free cash flow generation, the net debt reduction was achieved through the significant proceeds from the sale of our UK and Portuguese tile roofing businesses. The net debt in 2019 includes the favourable effect of the non-recourse factoring programme set up in 2015, which amounted to EUR 154 million at the end of the year (vs EUR 159 million at the end of 2018). Excluding this programme, the net financial debt would have reached EUR 485 million (vs EUR 743 million at the end of 2018). The company’s net financial debt/REBITDA ratio decreased from 1.4x in 2018 to 0.7x in 2019. Excluding the favourable impact of the non-recourse factoring programme, this ratio decreased from 1.8x to 1.0x year on year.

Considering the uncertainty in the context of the COVID-19 sanitary crisis, the Board of Directors will propose to reduce the dividend on the 2019 profit with 50%, bringing it to EUR 0.29 per share, at the Shareholders’ Meeting on 27 May 2020.

Revenue by division

Building Performance registered a like-for-like top-line growth of 8.0% to reach EUR 1,790 million, mainly attributable to strong growth registered in nearly all geographies. This reflects a combination of higher volumes and improved margins in plasterboard and associated products, especially but not exclusively in Europe, important projects in passive fire protection and volume growth in our fibre cement business in Africa and in Asia. This performance clearly illustrates the strategy developed by Building Performance to deliver first-class service to its customers, thanks to a reinforced supply chain with the commissioning of our new plant in Spain, the launch of new products as well as increased brand awareness in Europe.

The like-for-like revenue of Exteriors was down 3.1% year-on-year to EUR 592 million. This decline is mainly attributable to Northern Europe, Germany (corrugated sheets), Latin America and the United States. 2019 was a year of transition, as this new division, which centralises the fibre cement exteriors activities of the former Roofing and Facade divisions, was set up at the beginning of the year. The facade business continued to benefit from its strong reputation in the architectural segment and sidings while the fibre cement roofing activities were impacted by their exposure to the European agricultural sector. In 2020, the Exteriors division is expected to benefit from the efforts and investments made in quality, people and brands last year.

Excluding the disposed businesses in the United Kingdom and in Portugal (read more on p. 53), the like-for-like sales of Residential Roofing, a division that was also created at the beginning of 2019, were up 3.9% year-on-year at EUR 261 million. This is mainly thanks to our high-performing Creaton businesses in Eastern Europe. The German market for Creaton remained difficult, with declining volumes in line with the market evolution, but some price initiatives have been successfully implemented to limit the impact on revenue. 2019 was a turning point for Creaton: the investment in new products, the brand and the quality of service have started to pay off in Poland, Hungary and South East Europe, and should also benefit our German activities in 2020. Revenue in South Africa was flat.

Finally, Industry registered a like-for-like revenue growth of 4.3% to EUR 179 million, with a strong performance in mass transportation and fire-rated appliances. 2019 was the third consecutive year of strong organic growth as well as a record year in terms of revenues. The division benefits from its geographical diversification, the increased demand for fire protection solutions requiring highly rated certificates, and the approach by segment.

Key developments

Last year, Etex made notable achievements related to its six key strategic pillars. The most important milestones that have been reached are the following:

- The group’s GBP 140-million investment – the largest in the group’s history – on a new plasterboard factory in Bristol (UK), which underlines our confidence in the strong potential of the British market and the commitment to our customers. This new, state-of-the-art plant will feature energy- and resource-efficient production technologies.

- In order to maximise our position in fibre cement, the Exteriors division was launched in January 2019. It centralises the production capabilities, resources and technologies of all of our fibre cement activities, achieving greater agility, alignment and customer centricity. While 2019 was a transitional year, robust foundations in quality, innovation and branding were laid, paving the way for a promising future.

- In Residential Roofing, we have divested two large businesses last year, Marley Ltd (UK) and Umbelino Monteiro (Portugal). This decision is fully aligned with our strategy, as clay roofing tiles and components fall outside the scope of our ambition to become a global player in lightweight and modular construction. In Germany and Eastern Europe, we have successfully strengthened our Creaton brand.

- A new division dedicated to lightweight, dry and modular building technologies was created. Operational since January 2020, New Ways combines our expertise in fibre cement and plasterboard solutions with new methods of construction that are faster, more sustainable, resource friendly and affordable than traditional approaches. The division specialises in two core modular building technologies, wood and steel framing, and it comprises three businesses: E2E in Chile, Tecverde (majority owned by E2E since early 2020) in Brazil, and EOS in the UK.

In 2019, Etex also continued its journey towards purchasing excellence, strengthening category management and harmonising purchasing processes. These measures led to material savings of EUR 47 million and will be amplified in 2020.

Responding to the results of our first global employee engagement survey in 2018, we introduced the Etex Awards in 2019: three levels of recognition for individuals and teams that deliver exceptional performance, significant financial impact or breakthroughs on Etex’s strategic goals. 405 Etex Impact Awards and 66 Etex Excellence Awards were presented in 2019. Due to the outbreak of the Covid-19 sanitary crisis, the presentation of the first Etex CEO Award has been postponed until later this year.

Finally, Etex partnered with non-profit organisation Techo, a Latin American housing initiative fighting poverty in countries across the region, to build safe, beautiful, affordable and resilient modular homes for families in Peru. Our call for Etex volunteers generated a tremendous response, with over 400 candidates applying to participate. Together with Techo experts, the Etex volunteers demonstrated our shared commitment to ‘Connect and Care’ by improving the living conditions of nine families in the Ventanilla district near Lima. Moving forward, we will continue to build on our collaboration with Techo and set up new projects embodying our “Inspiring ways of living” purpose.

Outlook for FY 2020 determined by COVID-19 sanitary crisis

As the coronavirus pandemic (COVID-19) continues to develop and an increasing number of countries are announcing stringent containment measures, companies around the world are under pressure. Etex is no exception, and the impact of the virus outbreak on our business continues to evolve. Moreover, a number of Etex colleagues have been infected with the virus.

Continuing sanitary containment measures could adversely affect the results of our operations, financial position and net assets in 2020. So far, some of our production sites had to stop or significantly slow down their operations, while on specific markets we are experiencing a significant slowdown in demand. We have limited visibility on the potential impact of the virus on our markets in the coming months. Any disruption is uncertain, but we have robust governance and management tools in place to mitigate any potential impact and to monitor closely the level of spending.

At this stage we are not in a position to estimate the impact of this world-wide crisis on our financial performance in general. Nevertheless, we are confident that our tight control on costs will secure the present and future of Etex considering our strong financial position, strong balance sheet at the end of 2019, available financial resources and a careful management of our cash position.

Etex should have a clearer view on its outlook for 2020 when communicating on its half-year results on 31 August 2020.

Changes to the Board of Directors

Pierre Vareille left the Board of Directors on 29 October 2019. The mandates of Gustavo Oviedo and Philippe Vlerick will expire at the next general shareholders’ meeting on 27 May 2020.

Upcoming Shareholders’ Meeting

In light of the worldwide travel restrictions and social distancing recommendations by the Health Authorities, Etex is reviewing its options with regards to its shareholders’ meeting currently scheduled on 27 May 2020. More details will be communicated as soon as the relative legislative amendments have been adopted and published in Belgium.

Key figures for FY 2019

The consolidated financial statements for the year 2019 were approved by the Board of Directors on 2 April 2020 and will be presented for approval at the Shareholders’ Meeting.

The statutory auditor issued an unqualified audit opinion on the consolidated financial accounts.

The 2019 Annual Report of the company is available on Etex’s website https://etexgroup.com/annualreport2019 as of 6 April 2020.