2020 Half-Year Results: Decline in revenue with resilient REBITDA margin during COVID-19 crisis

Zaventem, 31 August 2020 – In the context of the ongoing COVID-19 pandemic, Etex reports a like-for-like1 decline in revenue of 10.8% and of 8.9% in REBITDA for the first half of 2020. The REBITDA margin remains remarkably stable compared to last year at 16.7%. The net recurring profit (Group share) is down 14.2% year-on-year at comparable scope.

Comment from Paul Van Oyen, CEO of Etex: “After a promising start to the year, as from mid-March, Etex has, unsurprisingly and like numerous industries around the world, been significantly impacted by the coronavirus pandemic, as demand collapsed in many of our countries of operation after confinement measures were implemented, and many of our factories temporarily stopped or slowed down their activities.

In these tough and unforeseeable circumstances, Etex has demonstrated praiseworthy responsiveness, flexibility and resilience. The crisis management team has taken swift actions to offset the financial impact of the crisis as much as possible, notably a 9% reduction in overheads, tight working capital management and a reduction of our capital expenditure programme.

Moreover, I am proud to say that our people came together to face this crisis. While many colleagues around the world – as well as the Executive Committee members – agreed to voluntary salary cuts, Etex put measures in place to protect its employees by guaranteeing no restructuring measures during the first three months of the crisis and by implementing a 75% minimum income level guarantee for all its employees.

In addition to our healthy liquidity position, employee engagement initiatives continued to bear fruit and the robust performance culture that we have built over the last year has proven to be a strong asset in the face of this crisis. As a result, our crisis management approach has been highly effective, reinforcing our vigilant focus on health and safety, as well as our communication efforts with both employees and customers.

Even while implementing our crisis management approach, we were able to achieve a number of important milestones on two fronts. We continued to accelerate the execution of our lightweight construction strategy – based on fibre-cement, plasterboards, passive fire protection and off-site construction – as well as that of our One Etex movement enabling us to be a more efficient and agile organisation.

All these initiatives have had a favourable impact, as we have been able to regain control over our results as from June. I am confident that, together with our strong financial position, strengthened even more by our performance and strategic achievements, these efforts will allow us to inspire ways of living during this crisis and afterwards.”

Strong start of the year offset by COVID-19 pandemic, control regained as from June

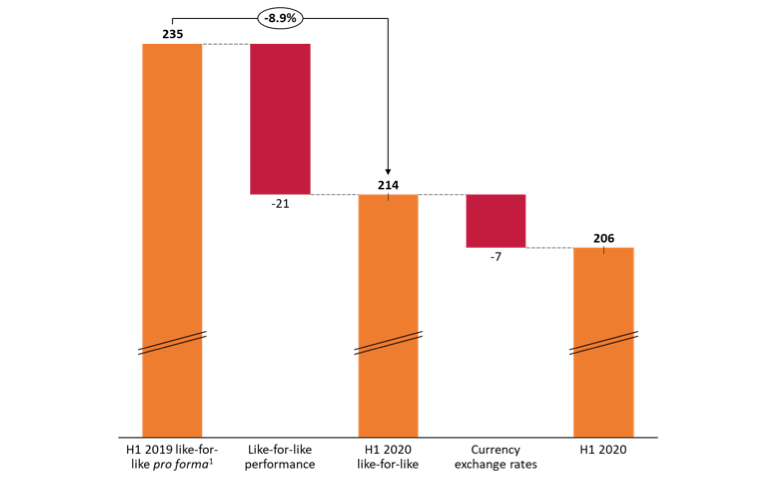

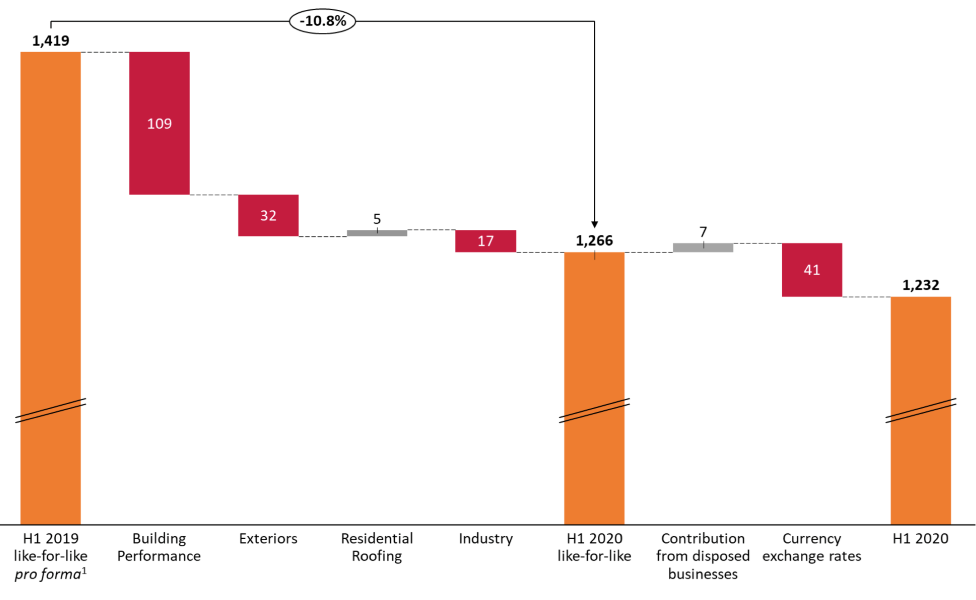

For the first six months of the year, Etex reports a revenue of EUR 1.232 billion, a like-for-like (same currency exchange rates and scope)1 decline of 10.8% year-on-year. Including the impact of the currency exchange rates and the change of scope, the revenue is down 18.8%. After a solid start to the year, Etex was hit by the COVID-19 pandemic as from mid-March, as some of our production sites temporarily stopped or slowed down their activities. All our activities have been impacted significantly except our Residential Roofing division which performed well year-on-year, as well as our activities in Central Europe in general. The impact from the crisis was softened as from June thanks to the successful implementation of measures to adjust overheads. The disposal of several residential roofing businesses - Umbelino Monteiro (Portugal) in August 2019 and Marley Ltd. (UK) at the end of the same month - has a significant impact on both revenue and REDITDA. The adverse impact from currency exchange rates is mainly due to the Nigerian naira and all Latin American currencies except the Peruvian sol.

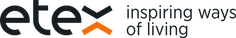

The recurring operating cash flow (REBITDA) has reached EUR 206 million, a like-for-like1 decline of 8.9% year-on-year, or -19.1% when including currency exchange rates and scope, compared to the first half of 2019. In our Building Performance division, the impact from the COVID-19 crisis was partially offset by positive price variances from raw materials, lower energy prices and a reduction in overheads. In the Exteriors division, a favourable mix, increased efficiency, lower energy prices and several cost reduction programmes have allowed to partially offset the impact of COVID-19. At Residential Roofing increased sales and margins as well as the impact of structural measures that were put in place last year have led to a significant REBITDA increase. As for our Industry division, despite solid margins, it was heavily impacted by a significant drop in sales and production stoppage or slowdown (mainly in Belgium and Italy). Reduced overheads could only slightly offset this impact.

While the REBITDA was significantly impacted by the crisis in absolute figures, the REBITDA margin remained remarkably stable at 16.7%, compared to the good performance of the first half of 2019 (16.8%).

Etex’s net recurring profit (Group share) was down 25.1% to EUR 75 million. When excluding the divested businesses at Residential Roofing, the decline reaches 14.2% year-on-year.

Over the last 12 months, the net financial debt (including lease debt2) has strongly decreased from EUR 640 million at the end of June 2019 to EUR 310 million at the end of June 2020, a reduction of more than 50%. The net financial debt/REBITDA ratio has improved from 1.4 x at the end of June 2019 to 0.7 x at the end of June 2020.

Revenue by division

Building Performance registered a like-for-like top-line reduction of 12.0% to EUR 771 million, mainly attributable to the impact of the COVID-19 crisis since mid-March in all regions, particularly in Southwest Europe, Latin America and Northwest Europe, despite a significant recovery in June in Europe.

The revenue of our Exteriors division is down 10.9% year-on-year on a like-for-like basis, at EUR 261 million. After a good start of the year, the revenue was impacted by COVID-19 as from mid-March. Most countries suffered with exceptions mainly in Germany, the Baltic countries and the US. The recovery started mid-April and, as from the end of May sales performance is approaching last year levels.

The revenue of the Residential Roofing division is up 2.6% like-for-like1 to EUR 120 million, thanks to the successful margin improvements in Germany and strong demand on the Polish market. Overall, the markets on which the division operates (Central and Eastern Europe) suffered less from the impact of the coronavirus crisis than other European markets.

The Industry division was severely impacted by the COVID-19 pandemic, registering a like-for-like revenue drop of 18.6% to EUR 75 million. Except Germany and Poland with revenue in line with the first half of 2019, all other countries have suffered.

Finally, New Ways, our new division set up in January this year, has recorded a revenue of 5.0 million in H1 2020.

Key developments

As from mid-March, numerous industries around the world have been severely disrupted by the consequences of the COVID-19 crisis, and Etex is no exception. The minimum occupation level of our factories has been reached as soon as end March, with around 50% of our factories stopped following decisions taken by Etex or national authorities. A growing number of factories have been re-started as from April thanks to the roll-out of sanitary preventive measures, and at the end of June our factory occupation level around the world was back at nearly 100%.

To face this unprecedented situation, Etex has put the following effective measures in place:

- Solid crisis management through a specially appointed Steering Committee taking daily and weekly key decisions in four areas: sales, finance, operations and Human Resources;

- Intensive exchange between the executive management and the Board of Directors;

- Regular updates and communication with all levels of the organisation through internal channels;

- 9% reduction in overheads thanks to HR-related cost reductions (fixed and variable remuneration cuts, hiring freeze, some governmental measures) as well as a freeze of marketing spend, consulting or travel expenses.

- Tight working capital management and capital expenditure projection cut down by 20% year-on-year

- Voluntary salary cut, and 20% salary cut by the Executive Committee members. Next to this, Etex put measures in place to protect its employees by guaranteeing no restructuring measures during the first three months of the crisis and by implementing a 75% minimum income level guarantee;

Despite these difficult circumstances, Etex managed to pursue its strategy to focus on its lightweight construction core business areas in the context of the ongoing residential roofing market consolidation across Europe. In July 2020, the company completed the divestment of two businesses in its Residential Roofing division:

- Etex disposed Marley (SA) (Pty) Ltd to the South African Kutana Investment Group with support of the managing director. Active in the national concrete tiles business, Marley (SA) (Pty) Ltd operates four plants and employs 300 people;

- Etex sold its 50% stake in RBB NV (Belgium), a company which produces concrete tiles, as well as its concrete tiles business in the Benelux, to BMI Group.

These two divestments follow two others completed by Etex last year, both in August: Umbelino Monteiro, our Portuguese clay tiles business, was sold to French based company EDILIANS, formerly Imerys Toiture, and Marley Ltd., one of our subsidiaries and the leading UK manufacturer and supplier of roofing tiles and components, was acquired by Inflexion Private Equity Partners LLP.

Special Shareholders’ Meeting

On 27 May 2020, as the company was facing a very uncertain COVID-19 outcome, the Annual General Shareholders Meeting of Etex approved the 50% reduction of the gross dividend on the 2019 profit. The gross dividend of EUR 0.29 per share was paid early July 2020.

In the light of the less than anticipated negative impact of the COVID-19 crisis on the financial results of the company at the end of the first half, and based on the current outlook for the remainder of 2020, the Board of Directors has decided to propose to the shareholders of Etex NV to approve the distribution of a gross dividend of EUR 0.29 per share, payable as from 13 November 2020. A special shareholders' meeting will be organised on 22 October 2020 in order to vote on this proposal. The convening notice for the meeting will be sent shortly.

Outlook for FY 2020

In the second half of the year, we expect that the deviation on revenue and REBITDA performance compared to 2019 will be significantly less detrimental than in the first half, as it is expected to be below 5%. The business is still particularly impacted outside Europe and proportionally more significantly in the Industry division. Our free cash flow generation is expected to be in line with 2019 thanks to a strict control of our capital expenditure and working capital, yet a cash impact due to the COVID-19 crisis will be visible in 2021.

Key figures for H1 2020

1. The like-for-like percentage compares H1 2020 to H1 2019, the latter being converted with identical exchange rates and excluding the Residential Roofing businesses divested in August 2019 (Marley Ltd and Umbelino Monteiro). The latter supports the pro forma values in the chart on p.2.

2. Since 1 January 2019, IFRS 16 requires the recognition of lease liabilities as part of the company’s financial liabilities.

3. Values are expressed excluding the favourable impact of the non-recourse factoring programme (EUR 200 million as of 30/06/2019 and EUR 161 million as of 30/06/2020).