Résultats semestriels 2019

Etex reports a like-for-like growth in revenue of 6.7% and of 17.3% in REBITDA for the first half of the year. The REBITDA margin is up to 16.8% vs 15.2% at the end of June 2018 on a comparable basis1. The net recurring profit (Group share) is up 6.3% year-on-year.

Comment from Paul Van Oyen, CEO of Etex: “In the first half of the year, I’m happy to announce that Etex has recorded a strong performance, both in revenue and REBITDA. This growth was achieved by strong market demand, mostly driven by our Building Performance division. Our other divisions have performed well, with the exception of Etex Exteriors which was slightly down year-on-year. On top of our operational performance, our net financial debt has significantly decreased by EUR 181 million2 over the last 12 months. In the second half of 2019, we expect to benefit from the same favourable trends, with a continued growth of revenue and REBITDA.”

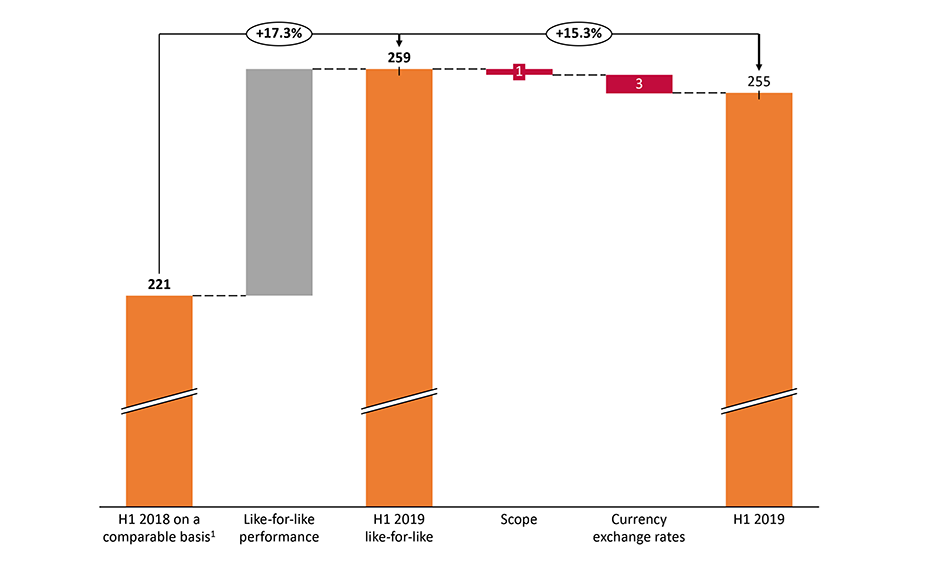

Contribution to REBITDA evolution from H1 2018 to H1 2019 (in million)

Significant increase in revenue and REBITDA mainly driven by Etex Building Performance##

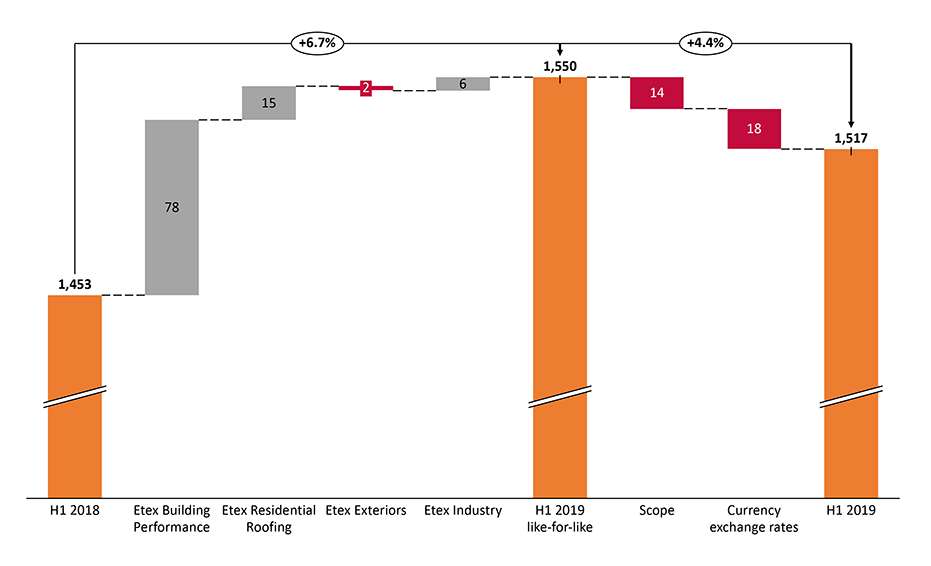

For the first six months of the year, Etex reports a revenue of EUR 1.517 billion, a like-for-like (same currency exchange rates and scope) increase of 6.7% year-on-year. Including the impact of the currency exchange rates and the change of scope, the revenue is up 4.4%. This solid performance is mainly driven by our Etex Building Performance division with strong plasterboard revenue. Our new division (since 1 January 2019) Etex Residential Roofing has progressed compared with 2018. Etex Industry has also recorded significant top-line growth. The revenue of Etex Exteriors – also a new division since 1 January 2019 – was slightly down, mainly due to lower volumes in fibre cement residential roofing in Latin America and residential façade in Europe, which were partially offset by strong growth in fibre cement residential roofing in Europe and a continued good performance in architectural façade globally. The slightly negative scope impact (-1.0%) is mainly attributable to the disposal of non-core businesses last year. The adverse impact from currency exchange rates (-1.3%) is mainly due to the Argentine peso.

The recurring operating cash flow (REBITDA) has reached EUR 255 million, a like-for-like increase of 17.3% year-on-year, or 15.3% when including currency exchange rates and scope, compared to 2018 on a comparable basis(1). At Etex Building Performance, the REBITDA benefitted from high plasterboard volumes, a favourable mix and pricing evolution, as well as from the positive impact of the significant restructuring measures that have been implemented at the end of last year. At Etex Residential Roofing, all countries performed well in the first half, with the exception of Germany where volumes have declined. Former manufacturing issues have also been solved in this division, contributing to its REBITDA growth. At Etex Industry, the REBITDA increase recorded by most of the regions was partially offset by the Middle East and Asia-Pacific – with the exception of Japan which performed well. At Etex Exteriors, the margin was negatively impacted by manufacturing variances associated with a slower than expected ramp-up of recent investments, as well as stock write-offs and increased transport costs. This was partially offset by a positive mix.

The REBITDA margin stands at 16.8%, a significant improvement compared to the first half of 2018 on a comparable basis1 (15.2%).

Etex’s net recurring profit (Group share) was up 6.3% to EUR 100 million. The company’s net profit reached EUR 96 million in the first half of 2019, up 10.2% year-on-year.

Over the last 12 months, the net financial debt has strongly decreased from EUR 719 million at the end of June 2018 to EUR 538 million at the end of June 2019(2), a EUR 181 million reduction. The net financial debt/REBITDA ratio has improved from 1.6 x at the end of June 2018 to 1.3 x at the end of June 2019. Including lease debt(2), the net financial debt amounts to EUR 640 million at the end of June 2019.

Revenue by division

Contribution to revenue evolution from H1 2018 to H1 2019 (in EUR million)

Etex Building Performance has registered a like-for-like top-line growth of 9.1% to EUR 916 million, mainly attributable to the strong performance of plasterboard activities in most markets. The Promat business and fibre cement volumes have also contributed to the top-line increase in the first half of 2019.

The revenue of our new Etex Exteriors division is flat year-on-year (-0.7%) on a like-for-like basis, at EUR 302 million. Increased volumes in fibre cement residential roofing in Europe were offset by lower volumes of fibre cement residential roofing in Latin America and residential façade in Europe, partially offset by price increases.

The revenue of our new division Etex Residential Roofing is up 7.9% like-for-like to EUR 208 million. This is mainly due to volume growth, especially in the UK and Poland.

Finally, Etex Industry registered a like-for-like revenue growth of 6.8% to EUR 92 million. Driven by strong demand from the OEM, Transportation and Energy segments, most regions and business segments have performed well. The strong performance of the Promat and Microtherm businesses in France, Spain, the UK and Japan was partially offset by weaker demand from the Oil & Gas sector in the AMEA region.

Key developments

Last year, Etex decided to** reshape two of its four divisions**: Etex Roofing and Etex Façade. Since 1 January 2019, our clay, concrete and components activities for residential roofing in Europe and South Africa are combined in a newly created division, Etex Residential Roofing. On the other hand, the fibre cement activities of Etex Façade and Etex Roofing have been brought together within the new Etex Exteriors division, a move which will allow us to maximise our position in fibre cement. We are confident that these two divisions will ensure that every Etex business segment has a well-balanced, forward-minded solutions portfolio in the face of a changing market.

In line with its strategy to concentrate on its core businesses, Etex has successfully achieved two major divestments after the first half of the year. In August, Etex sold its Portuguese clay tiles business to French based company EDILIANS, formerly Imerys Toiture. All activities of Umbelino Monteiro related to fibre cement building materials, a core technology of Etex, remain with Etex. At the end of the same month, the company also announced the sale of Marley Ltd., one of its subsidiaries and the leading UK manufacturer and supplier of roofing tiles and components, to Inflexion Private Equity Partners LLP. The sale was successfully closed on 30 August.

Outlook for FY 2019

In the second half of the year, we expect to witness the same favourable trends generating strong volumes in our different businesses. Measures will also be implemented to make sure our manufacturing capacity can meet this strong demand. The REBITDA of Etex is also expected to remain strong. The United Kingdom should experience further growth, except for the unforeseen aftermath of a “hard” Brexit, although measures were put in place to face this situation.

Key figures for H1 2019

| EUR million | H1 2018 | H1 2018 on a comparable basis | H1 2019 | Var.% | Var.% like-for-like (same scope & rate) | |

|---|---|---|---|---|---|---|

| Revenue | 1.453 | 1.453 | 1.517 | 4,4% | 6,7% | |

| Recurring operating cash flow (REBITDA) | 207 | 221 | 255 | 15,3% | 17,3% | |

| % of revenue | 14,3% | 15,2% | 16,8 | - | - | |

| Recurring operating income (REBIT) | 130 | 130 | 164 | 26,6% | 26,6% | |

| % of revenue | 8,9% | 8,9% | 10,8% | - | - | |

| Non-recurring items | -12 | -12 | -9 | - | - | |

| Operating cash flow (EBITDA) | 195 | 209 | 246 | 17,8% | - | |

| Operating income (EBIT) | 117 | 117 | 155 | 31,8% | - | |

| % of revenue | 8,1% | 8,1% | 10,2% | - | - | |

| Profit for the year | 88 | 88 | 96 | 10,2% | - | |

| Group share | 85 | 85 | 94 | 9,9% | - | |

| Non-controlling interest | 2 | 2 | 3 | - | - | |

| Net recurring profit (Group share) | 94 | N/A | 100 | 6,3% | - | |

| Working capital | 448 | N/A | 395 | - | - | |

| Net financial debt (excl. lease debt) | 2 | 719 | N/A | 538 | - | - |

| Net financial debt (incl. lease debt) | 2 | N/A | N/A | 640 | - | - |

| Capital expenditure | 48 | N/A | 35 |

- 2018 figures have been restated to reflect the impact of IFRS 16 (impacting lease accounting since 1 January 2019) on depreciation and the (R)EBITDA,which is estimated at EUR 14 million.

- Since 1 January 2019, IFRS 16 requires the recognition of lease liabilities as part of the company’s financial liabilities. For more details on the impact of lease debt, see table page 4.

- Values are expressed excluding the favourable impact of the non recourse factoring programme (EUR 200 million as of 30/06/2019 and 30/06/2018).