2020 Full-Year Results and Annual Report

Highlights:

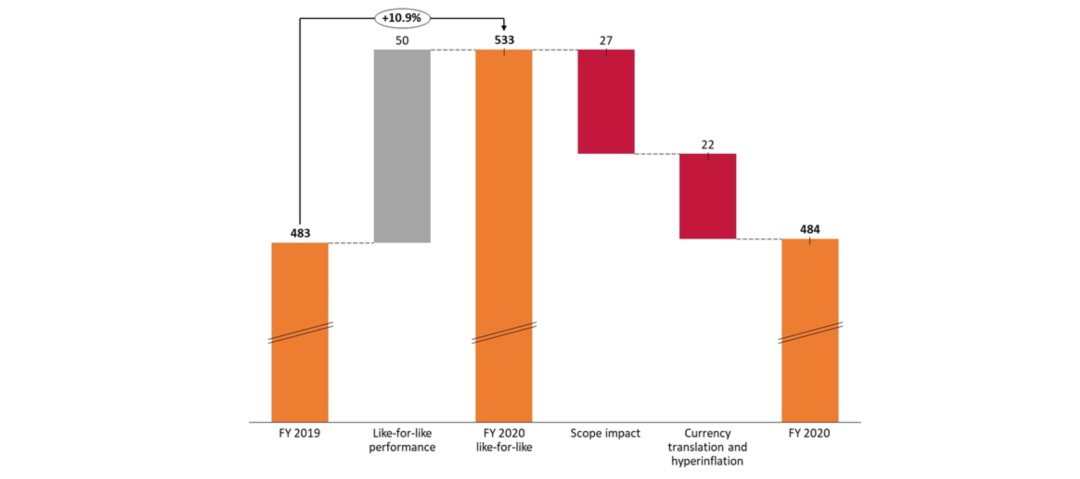

- Like-for-like revenue decrease of 3.1%, mostly due to the impact of the COVID-19 pandemic

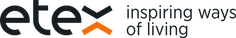

- Significant increase in like-for-like REBITDA with 10.9%, mainly thanks to the combination of improved margins and contained overheads

- Significant increase in net recurring profit (Group share) at EUR 215 million (+ 15.1%), another record performance

- Highest ever free cash flow before dividends, acquisitions and disposals at EUR 313 million

- Lowest net financial debt ever at EUR 15 million

- Dividend over 2020 profit: proposal by the Board of Directors of EUR 0.70 per share

- Outlook for 2021: positive order book in H1, uncertainty for H2. Revenue expected to be affected by COVID-related volatility this year and the next

- Digital Annual Report 2020 available on https://www.etexgroup.com/annualreport2020

Comment from Paul Van Oyen, CEO of Etex: “2020 was a year of crisis management and resilience, but also a year of caring and acceleration of our strategy execution. In everything that we undertook during this unprecedented year, our number one priority was – and continues to be – the safety and well-being of our people. Etex rapidly went into crisis mode, creating a dedicated crisis management team, implementing ambitious cost control measures and intensifying communications with our people. We strengthened local decision-making, enabling our leaders on the field to take the right steps and inspiring the trust of our people. On the manufacturing side, we rapidly closed factories for several weeks and defined very strict safety rules. Overall, we have never lost sight of our purpose, and ‘Inspiring ways of living’ has continued to be our tangible contribution to the world despite numerous obstacles.

Therefore, I am proud to report that Etex has weathered the storm. We have made significant progress on our strategic roadmap, notably by divesting our last Residential Roofing assets and by making a number of key acquisitions in our plasterboard, passive fire-stopping and modular and offsite construction activities. On the financial side, the COVID-19 pandemic naturally took its toll by impacting the top-line of our all divisions except Residential Roofing. That being said, Etex delivered an outstanding performance in profitability, recording a like-for-like increase of 10.9% in REBITDA. Moreover, our net recurring profit (Group share) is up by 15.1%, and the company is almost debt-free currently.

Our top-line is likely to be challenged this year and the next, but our performance culture is in place and our eagerness to focus on sustainability and our customers strengthened. The acquisitions we made in 2020 will fuel our future growth in high-potential markets. In 2021, we will continue to identify new opportunities, as we are currently in an excellent position to make significant investments.

Finally, at the General Shareholders’ meeting of Etex on 26 May 2021, Jean-Louis de Cartier de Marchienne will reach the end of the maximum number of terms as Chairman of the Board of Directors. At the first Board meeting following the General Shareholders’ meeting, it will be proposed to appoint Johan Van Biesbroeck as his successor as Chairman. I would like to take the opportunity to thank Jean-Louis for his entrepreneurial spirit, dedication and support to the executive management team. Since 2006, he has guided Etex through challenging times, such as the 2008 financial crisis and the current COVID-19 pandemic, and many strategic achievements, such as the acquisition of Lafarge in 2011, the divestment of our ceramics business in 2016 or our recent exit from our Residential Roofing activities. Moreover, the company has improved its governance under his guidance. The Board of Directors and Etex employees acknowledge and are tremendously grateful for his essential role in the successes of Etex.”

Annual Report 2020: Etex teammates tell the story

In the Annual Report dedicated to our performance and achievements in 2020, we have highlighted four ‘Inspiring stories’:

- As part of our digital roadmap, the regional supply chain and customer service team in Latin America rolled out an omnichannel customer service platform that will serve as the basis for delivering exceptional customer experiences worldwide.

- To serve the needs of our customers in markets where we have no manufacturing footprint, the Exteriors division relies on compact organisations spread across the world. Our colleagues in these offices share the trials and triumphs of operating without larger fibre cement production facilities within close proximity.

- As building safety norms and standards play an increasingly vital role in new construction, the Etex team in India is proactively helping to shape the market for fire-rated doors through an innovation-minded partnership with Narsi, one of India’s premium building solution manufacturers.

- Timber-framing technology specialist Tecverde, collaborated with steel company Brasil ao Cubo on an ambitious project: building and expanding a number of hospitals in Brazil to ease the pressure of the pandemic.

To complement the Annual Report, readers can discover a video where Etex’s CEO Paul Van Oyen engages in a ‘COVID safe’ conversation with six teammates who explain how the company cared about people, safety, performance, strategy, lightweight construction… and the world, last year.

Watch the video and/or download the full Annual Report

Challenged top line, yet remarkable performance in profitability and lowest net debt ever

In 2020, Etex recorded a like-for-like (same currency exchange rates and scope) revenue decline of 3.1% to EUR 2.616 billion. This decrease is lower than the global economic recession in 2020. The decline in revenue is due to severe lockdown measures which were taken in several geographies, mainly in the second quarter, resulting in market demand contraction and the temporary closure of several plants. Despite strong investment in brands, improved service levels and a catch-up movement in sales post lockdown, all Etex divisions recorded top-line decline except Residential Roofing. The 4.2% negative scope impact is mainly attributable to the disposal of our Residential Roofing businesses in the United Kingdom and Portugal in 2019, as well as in South Africa mid-2020. This impact was partially offset by the acquisition of FSi Limited, a passive fire protection business in the UK in 2020. The remaining 3.7% negative impact on revenue is due to foreign currency translation mainly from a weaker Argentinian and Chilean peso, Brazilian real and Nigerian naira. Including the change of scope, the currency exchange rates and hyperinflation accounting impacts, the revenue was down 11.0%.

The recurring operating cash flow (REBITDA) reached EUR 484 million, a like-for-like increase of 10.9%. This outstanding performance in these unprecedented circumstances is mainly attributable to the combination of improved margins and contained overheads. Margins increased thanks to product mix management as well as cost reductions in external procurement and our own production processes. Overheads were strictly controlled from the beginning of the COVID-19 pandemic, with a like-for-like reduction of 5.9% to be compared to a like-for-like reduction of 3.1% in revenue. As a result, the REBITDA margin reached its highest level ever at 18.5%, compared to 16.4% in 2019, despite negative impacts of scope (6.1%), foreign currency translation and hyperinflation accounting (4.6%) compared to 2019.

Etex’s net recurring profit (Group share) was up by 15.1% to EUR 215 million in 2020, another record performance. The non-recurring items relate to restructuring initiatives and consequent impairment (mainly linked to the closing of our plasterboard-paper production facility in France) and to significant gains on the disposal of non-operating assets and businesses. The company’s net profit reached EUR 201 million in 2020, up 11.4% year-on-year.

At the end of December 2020, Etex’s net financial debt decreased to EUR 15 million, a reduction of EUR 316 million compared to its level at the end of December 2019 (EUR 331 million). This reduction reflects the strong free cash flow generation, with a free cash flow before dividends, acquisitions and disposals of EUR 313 million (compared with EUR 152 million in 2019), and, to a lesser extent, the disposal proceeds net of acquisitions. The net debt in 2020 includes the favourable effect of the non-recourse factoring programme, which amounted to EUR 159 million at the end of the year (vs EUR 154 million at the end of 2019). Excluding this programme, the net financial debt would have reached EUR 174 million (vs EUR 485 million at the end of 2019). The company’s net financial debt/REBITDA ratio improved from 0.5x in 2019 to -0.2x in 2020. Excluding the favourable impact of the non-recourse factoring programme, this ratio improved from 1.0x to 0.4x year-on-year.

At the Shareholders’ Meeting on 26 May 2021, the Board of Directors of Etex will propose, on top of the expected 10% increase, to exceptionally increase the dividend on the 2020 profit with another 10%, to EUR 0.70 per share (+20.7% in total).

Revenue by division

Building Performance registered a like-for-like revenue decline of -3.4% to reach EUR 1,639 million, due to the COVID-19 pandemic impacting nearly all geographies. Revenue was severely impacted from mid-March, mostly in Southwest Europe, Latin America and the UK, and was only partially offset by solid performance in Eastern Europe. The retail segment experienced little impact of the pandemic with an increase of DIY and renovation, while the project segment was heavily impacted in some geographies. Building Performance managed to improve its performance in a pandemic context thanks to the rebound of sales in the second part of the year, catching 4up volumes which had been heavily impacted during the second quarter, and cost savings (including in procurement) which partially compensated COVID-19 impacts. The innovation ratio of Building performance in 2020 reached the same level as in 2019. Globally, nearly 30 products were launched, including innovative and exclusive technologies such as Defentex.

The revenue of our Exteriors division (EUR 569 million) was impacted by a EUR 4 million like-for-like reduction (or -0.7%), mainly attributable to the Netherlands (discontinuation of subsidies and the Dutch nitrogen crisis), Ireland, Northern Europe and Peru (corrugated sheets). In the residential segment, all European markets recovered well in the second half of the year, driven by strong activity in home repair, maintenance and improvement. The Exteriors division resisted well thanks to its sidings and slates segments, which experienced an overall increase of sales in 2020, driven by a strong renovation market. The architectural segment was impacted by a lack of new projects directly linked to the COVID-19 crisis and, like in 2019, fibre cement activities were impacted by their exposure to trends in the agricultural sector.

Residential Roofing, excluding the divested businesses in the United Kingdom and in Portugal in 2019, recorded an increase in revenue of 4.9% like-for-like in 2020, to reach EUR 253 million. This is mainly thanks to the improved performance of the Creaton businesses in Germany and in Poland. Overall volumes remained flat, but product mix improvements led to a positive impact on revenue.

Industry registered a like-for-like revenue decline of 18.9% to EUR 144 million. The division was heavily impacted by the COVID-19 situation in almost every geography, with Germany and Austria being less impacted. Overall, all segments suffered, with a slow recovery expected for the oil & gas and transportation segments, while other business areas showed some recovery in the second half of last year.

New Ways revenues declined by 8.9% to EUR 10 million, mainly affected by the impacts of the pandemic on the UK market. New Ways revenues exclude our non-consolidated participations in several joint ventures.